Menu Of Services

We Specialize in providing comprehensive wealth management services to individuals, families, and business owners. Our team is committed to serving our clients as unique partners who require individualized solutions and comprehensive strategies, empowering them to make their own decisions. Above all else, we value the relationships and trust that we build.

Investments

- Simple IRA

- Treasury Issuance

- Bonds

- Alternative Investments

- Roth IRA

- SEP IRA

- Traditional IRA

- Brokerage and Advisory Accounts

- Government Securities

Financial Planning

- Retirement Planning

- Estate Planning

- Complex Withdrawal Strategies

- Executive Benefit Plans

- Comprehensive Consulting

- Tax Efficient Strategies

- 401(k) Planning

- 403(b) Planning

- Profit Sharing Plans

- Money Purchasing Plans

- And More...

Insurance

- Annuity Strategies

- Life Insurance

- Disability Income Insurance

- Long Term Care Insurance

- Income Insurance Plan

- Joint & Single Life

- Universal, Whole, Term

- Cost Analysis and Comprehensive Strategizing

Investment Management

Asset allocation is crucial for your portfolio, aligning your risk profile with your investments to help you commit to your financial goals. The right mix of assets depends on your goals, time frame, and risk tolerance.

"You should have a strategic asset allocation mix that assumes that you don't know what the future is going to hold."

Financial Planning

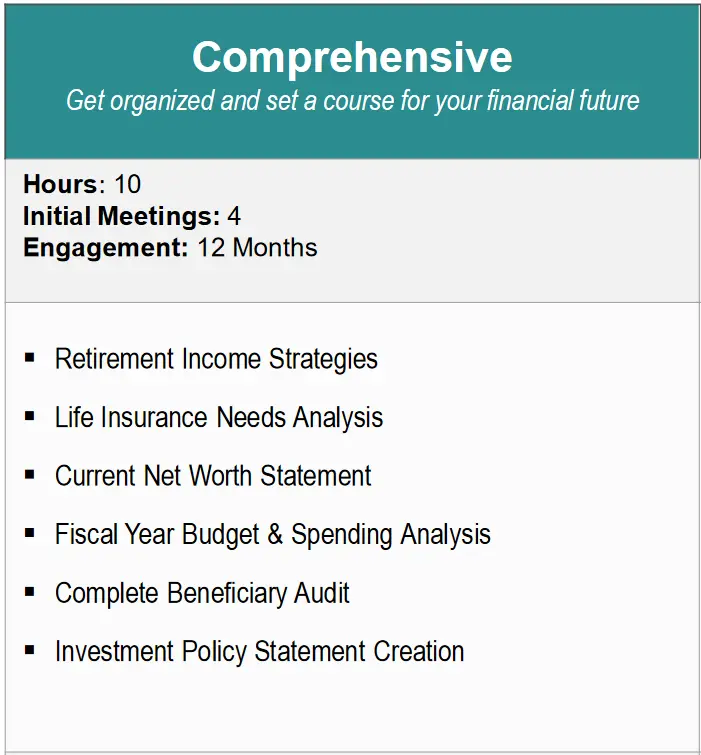

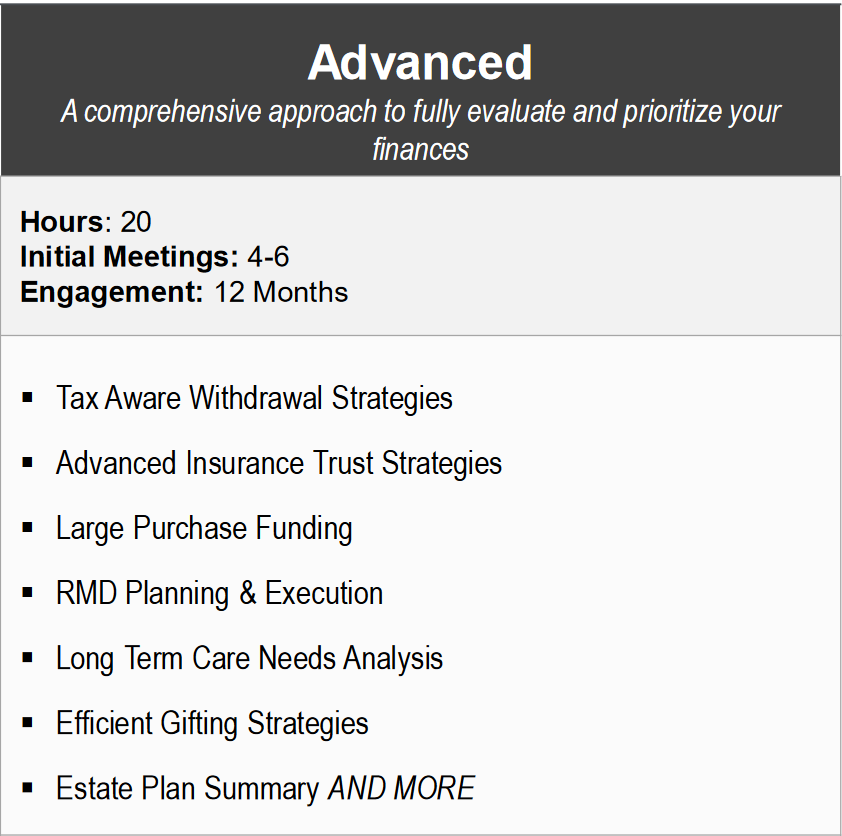

Our team of seasoned financial advisors will collaborate with you to craft a comprehensive financial plan tailored to your long-term objectives and evolving short-term needs. With a customized approach, we strive to deeply understand your unique circumstances and provide clarity to empower you in making informed decisions about your financial future.

Integrity

Some of the less talked about pillars of this industry are respect and integrity. We commit to a fiduciary standard, only achieved if we listen and strategize to your needs and objectives - this begins and ends with respect. We PROMISE to treat you as we want to be treated and always do right by our clients.

“It’s simple arithmetic: Your income can grow only to the extent that you do.”

Strategize and Excel

with Your Legal and Tax Professionals

Asset Management, Risk Management, and Insurance

Individual Wealth Management

Small Business Solutions

Tax Planning

When it comes to managing tax liabilities, capital market investors can employ various tax strategies like Tax-Loss Harvesting, Tax-Efficient fund selection, tax deferrals, and more.

It's worth noting that tax regulations can be intricate and subject to frequent changes, so it's advisable to seek guidance from a tax professional or financial advisor to grasp how these tactics might be relevant to an individual's specific circumstances and to ensure adherence to the current tax laws.

Education Planning

It is no secret that college tuition, books and housing is rising annually. In fact, on average, American families cover almost 20% of college costs by borrowing according to Sallie Mae. We believe that with the right tax efficient plan, you do not need to be a part of that statistic to allow your loved ones the leg up they need.

Before you invest in a 529 Plan, it's important to check if your state offers any tax advantages or special benefits, such as scholarships, financial aid, or protection from creditors, that are specific to the state's qualified tuition program. Withdrawals for qualified expenses are tax-free at the federal level. State tax treatment may vary. It's wise to seek guidance from a tax professional before making any investment decisions.

Horizon Wealth Management and LPL Financial do not offer tax/ legal advice or services.

Estate Planning

Estate planning encompasses the strategic arrangement of property transfer upon one's demise, alongside addressing various personal affairs. It may encompass tax planning considerations, depending on the individual's circumstances.

Following an individual's passing, their estate must be effectively transferred to designated beneficiaries, be it a spouse, offspring, grandchildren, or charitable organizations. Thoughtful planning can mitigate the risk of prolonged legal disputes.

The fundamental documents typically associated with Estate Planning include a Last Will and Testament, a Trust, a Health Care Proxy, and a Power of Attorney. Each of these instruments serves a distinct purpose in executing an individual's directives concerning asset distribution and, in certain instances, end-of-life decisions.

Retirement Planning

Our team of seasoned advisors will collaborate with you to construct a comprehensive financial plan aimed at ensuring long-term financial stability while addressing your short-term requirements. Through our individualized approach, we meticulously analyze your situation to develop a tailored plan that aligns with your unique circumstances. We are dedicated to prioritizing your objectives and providing you with a clear understanding of your financial position, empowering you to make well-informed decisions for your financial future.

From Qualified Longevity Annuity Contract (QLAC) and Qualified Domestic Relations Orders (QDRO) to Permanent Life Insurance, IRA's and Profit Sharing plans, our experienced team has the tools and techniques to address all aspects of your financial security in retirement.